“…In this world nothing can be said to be certain, except death and taxes.”– Benjamin Franklin

Since the former sounds easier, let’s talk only about the latter. Anxiety starts mounting all over the world as the Tax return filing date approaches. Your CA starts asking all kinds of data followed by curious questions about it. The method that I share here should make this dreadful yearly ordeal feel like a breeze. Also, don’t miss the special tips at the end about how to be consistent in applying this method, which is often the hardest part!

The idea is to provide data for the whole financial year to your CA in a jiffy. The trick lies in collecting data more frequently than doing only at the year-end, optimally monthly. There are a couple of benefits:

-

We have now split a big task into 12 smaller ones that are smaller and so easily doable.

-

Recollecting information about the transactions is a lot easier as they are reasonably fresh in your memory (In fact, this indirectly allows reflecting on them to make or adjust future plans associated with those items).

-

While you are at it, you could turn this exercise into a more elaborate monthly reconciliation process.

This is what we do:

Create a spreadsheet for your tax returns information with one worksheet each for a financial year. Every month, in a certain designated week, you should generate statements of all your bank accounts (UPI and credit cards if necessary) only for the unreviewed period and do the following:

-

Record all the credit (income) transactions into the spreadsheet, under the right heads. Some common heads could be, interest from various accounts, dividends, redemptions of mutual funds, rent, and most importantly non-taxable transactions. For every transaction, write the date of transaction, amount, name of the bank, and as much detailed information in the Remarks column, including some from the bank statement itself.

-

Record only the debit (expenses) transactions that are important from the Tax point of view, under the right heads, such as donations, insurance premiums, school fees, Advanced Tax, etc. (Discuss with your CA if you are not sure about what transactions should matter to you).

-

After completing this exercise, add/update the date in the top row with the date till which you have processed the information. This will help to find out the exact unreviewed period for the following month.

-

At the end of the financial year, “protect” the worksheet with no password so that it is protected from accidental edits and at the same time you don’t have to remember the password. You will have to share a copy of the worksheet (not the whole workbook) with your CA.

-

You may even draft an email to your CA and attach this spreadsheet and other information and wait for your CA’s call. How would you feel to send this mail in a jiffy back to your CA – breeze, right?

-

To create a blank template for a new financial year, copy the last year’s worksheet in the same workbook and delete the contents but retain the heads. It helps to have a single workbook with data from all financial years together.

-

You could optionally attach other rituals to this exercise, such as scheduling payments, paying bills, recording expenses for budgeting purposes, etc.

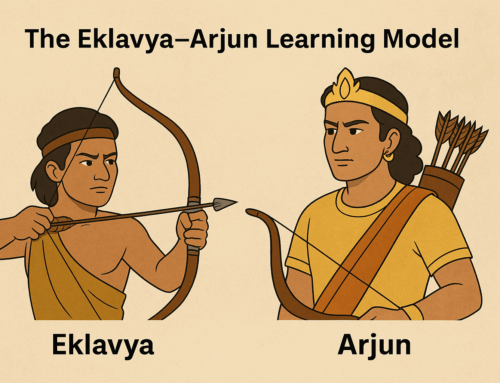

The above looks great to read but one has to be consistent in doing it, which is not easy. Here are some tips that will enable you to be so.

-

Create browser bookmarks for all the required bank login pages on the bookmarks bar of your browser for quick access.

- Create a couple of checklists to follow every month. One checklist would be of all the steps of processing.

- Create a shortcut to this spreadsheet itself so that you could access it quickly.

- Create a calendar event with monthly recurrence, so that you will be reminded about it on time. Once you get a reminder, create a task on your to-do list, so that you will not miss doing it.

Be regular with it and get one more thing in your life under your control!

Now that a brand new financial year has just started (in India), it will be a good time to start this. Others, of course, could also start now, to get the rest of the year covered well. Shoot me an email if you need a ready-made template for this spreadsheet.

Subscribe to my newsletter, to get tips like this and more, directly in your inbox!